We believe in radically better

Cuvva are disrupting the insurance industry by giving users an accessible and truly flexible way to manage their car insurance through an app focused experience.

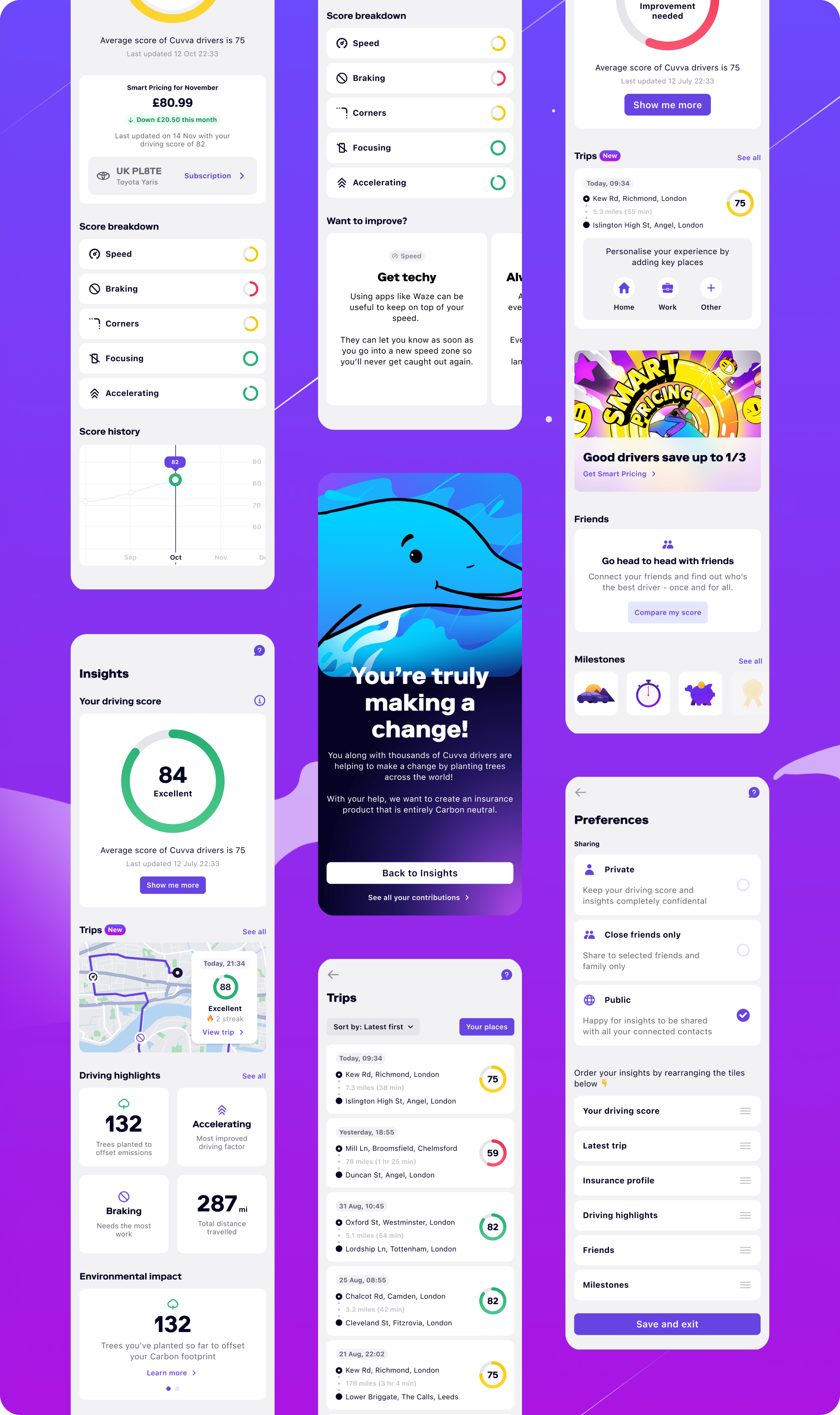

My role has focused on developing a digital solution that allows for users to gain valuable insights into their driving behaviours in order to educate, engage and effectively push users to join our Smart Pricing product.

Company: Cuvva

Role: UX + UI + Strategy + Research

Educating to give our users context, transparency and confidence.

Cuvva offers a range of different products in order to give users enough flexibility and choice. However, they can also be quite scary for users who are not used to our redefining approach towards insurance.

I developed an initial learning piece to allow for users landing on our ‘Insights’ feature to simply and effectively get all the relevant information they need before enrolling in it. The feature works by enabling a users location permissions so ensuring trust in our we use and secure their data was essential.

Creating an easily digestible able design approach that allows for the feature to scale over time as well as adapting to different user needs.

Even though the Insights tab would only initially present users with a breakdown of their driving score, the end aim is to cater for an experience that becomes full of data and insights unique to each user. Taking inspiration from similar design patterns used in the industry today, as well as testing prototypes with a range of relevant user types, I was able to establish an effective hierarchical based logic that will take a range of factors in to account. We also wanted to create enough flexibility and choice for a user to dictate their own personal hierarchy of importance.

A space for drivers to engage with our app and keep them coming back.

Through numerous rounds of user testing initial concepts (from wireframes to rapid prototyping), we developed an iterative roadmap of features we want to slowly roll out on our Insights tab. Using data and analytics we would observe user behaviours and feedback to help inform how we want to develop and add to the feature. Each new idea went through the same process of being tested, iterated on and developed.

The aim was to fundamentally create an experience that was live, rich and full of meaningful data that helps create user retention, keep them engaged with our app, and most importantly provide them with value, trust and transparency with the brand.

The road to Smart Pricing

Along with collaborating with engineers, product owners, content and researchers, I was able to define key user types and establish how each touchpoint will differ for users with differing driving scores.

The role of the Insights tab is to serve as a key touchpoint to give good drivers enough context and encouragement to join our Smart Pricing subscription product. With a good driving score, drivers could get a fairer and cheaper insurance price specifically based on their driving behaviour - bad drivers would be given tips on how to improve their score. If a user is already on Smart Pricing their experience will also include a component specifically based on their pricing. A wider plan to include touch points such as push notifications, emails and other forms of marketing to communicate with users is also in development.